COMPLIANCE

december 31st renewals:

- ifta stickers

- unified carrier registration (ucr)

- new mexico permit

- kentucky inventory report

june 30th renewals:

- hazmat permit

- scac codes

- 2290 (heavy highway use tax)

*new yoRK permit expires every 3yrs on december 31st

*dot (mcs-150) update should be done every year on your anniversary date.

fuel taxes

1st quarter tax return:

january / february / march (due: april 30th)

2nd quarter tax return:

april / may / june (due: july 31st)

3rd quarter tax return:

july / august / september (due: october 31st)

4th quarter tax return:

october / november / december (due: january 31st)

Minimum legal requirements

tmg will need at least your odometer readings and legiBLE fuel receipts showing state and gallons purchased in order to calculate your fuel tax.

****NOTICE****

from the date your iFta license is applied for & goes into effect is the quarter you must begin filing.

****reminder****

all deadlines are state regulated. in order to have them submitted on time without penalties, you must return them TO TMG in advance.

irp/tag/registration

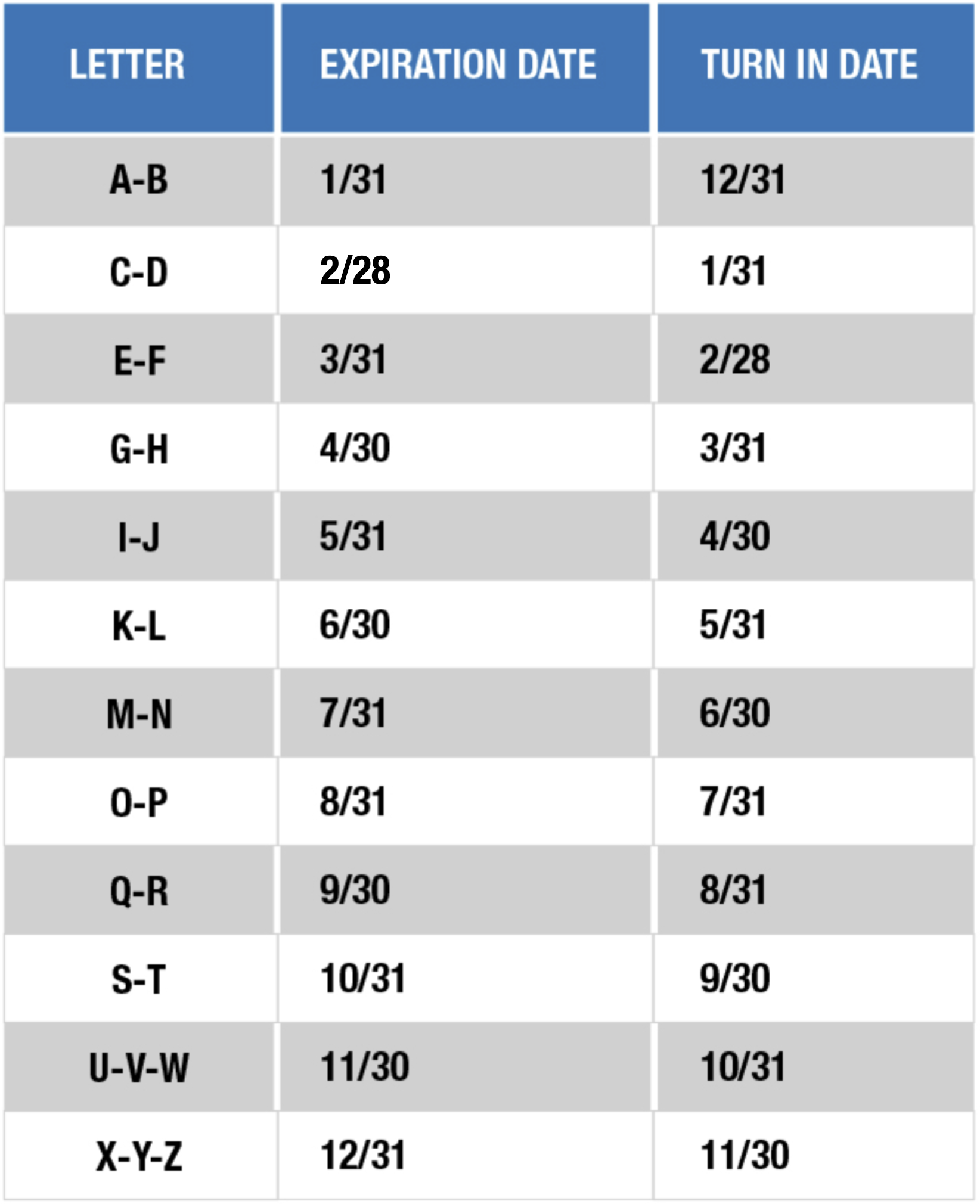

to determine when your IRP needs to be submitted, please see the chart below

use the first letter of your legal company name or the first letter of the sole proprietor's last name. this will be for the name that is listed AS registrant on the actual cab card.

renewal forms must be turned in one month in advance or there will be a penalty.

ad valorem taxes are now included in your IRP bill. your have until your expiration date to pay the IRP bill. if paid after, another penalty will be assessed.